Debt Ceiling Crisis 2017 Is Unlike Past Years: 3 Reasons Why Threat Is Real

September is going to be brutal on Capitol Hill. A cauldron of legislative initiatives is coming down the pike, with debt ceiling negotiations foremost on the agenda. By September 30, Congress must pass an annual spending bill to fund much of the U.S. government. Surely, a debt ceiling crisis will be averted after some predictable last-minute political theater, right? Not so fast.

This is the Donald Trump administration, after all. Despite the ambitious “Make America Great Again” (MAGA) platitudes and wholehearted effort to get that agenda rolling, Trump’s got nothing to show for it. About the only “legislation” being passed since his inauguration has been the 44 executive orders (EOs) he has passed since January. Everything is getting stonewalled, with every initiative being resisted by both friend and foe. It’s truly odd to witness an administration with majorities in both House and Senate so divided.

Also Read: How Much Is the U.S. Debt Ceiling & How High Will It Go Under Trump Presidency?

Despite historic levels of chaos in the White House, many people believe that a debt ceiling crisis won’t happen. People are used to the bluster and political theater being dissipated into empty threats. It’s akin to the boy who cried wolf too many times. But what if this time, the wolf really does enter the premises? I can see it happening.

If it does, that will spell bad news for the economy and the American consumer. A debt ceiling crisis has the potential to irreparably damage the U.S. credit rating. This is important for America’s “soft power” influence in the world through the U.S. dollar. A withering and unstable dollar does not go hand-in-hand with world reserve currency status.

A debt ceiling crisis could also shut down portions of the U.S. government. This would have real-world consequences for tens of thousands of government personnel who would not get paid. Not to mention that whole government sectors would go idle until new debt funding is approved. It could also pull a recession forward, as government spending accounts for about three-tenths of gross domestic product (GDP). Stock markets would destabilize in kind.

Because of at-stake risks, red and blue usually come together. But the political dynamics are unquestionably different this time. It’s quite possible that the political divide in America is the greatest it has been since the Civil War. Instead of North vs. the South, it’s liberal urban America vs. rural flyover America. There’s political disarray everywhere, and polarization of society is at extreme proportions.

Those few reasons are just a teaser. In the list below, I highlight three specific reasons why this debt ceiling debacle may be the real thing.

1. The Politics Look Daunting

Getting a budget spending and debt ceiling bill through the House of Representatives should be (presumably) easy enough. All that’s needed is a simple majority vote. Republicans hold a 43-seat majority there, so even if every Democrat and some “Never Trumpers” cross the aisle, some maneuverability still exists. But, as we saw with the twice-failed attempt at replacing the Affordable Care Act (ACA), nothing’s a given.

The real problem will be getting the bill through the Senate. Why? Because the Senate vote, when floored, will require 60 votes to pass and not a simple majority. Republicans only hold 52 of 100 seats in this chamber. Ergo, simple math dictates that a minimum of eight Democratic votes are needed to avert a debt ceiling crisis. And there are only 12 business days from the end of summer recess to accomplish this. A real challenge in the best of times.

But as legendary author Charles Dickens wrote, “It was the best of times, it was the worst of times.” We’re currently stuck in the latter. The historical divide that’s engulfing America’s two political parties is at epic proportions. The examples are too numerous to fully document, but when the biggest meme circulating in the opposition party is “resistance,” you know there’s a problem. Maxine Waters, I’m looking at you.

One has to wonder whether “resistance” from anti-Trump factions will go all the way. Could they use a debt ceiling crisis as a battering ram to “prove” that Trump is unfit to lead office? If parts of the government shut down, if the stock market tanks, if interest rates spike…at some point Trump-supporting conservatives just might have enough. The opposition will never be able to oust Trump with cries of “racist” or “Russian collaborator.” In the Internet age, too many are savvy enough to spot identity-politics propaganda. But hit them in their pocketbook or mess with their government programs, and the masses might get riled up.

In short, I worry that the anti-Trump coalition is okay with debt ceiling negotiations failing. It gives them ammunition to blame Trump for the fallout. The resulting after-effects could be the most effective “resistance” of all, from an opposition perspective. Yet more additional legislative failures could be just the boost that Democrats need for next year’s Congressional elections.

Despite all the faux pas in Washington, they’ll need it.

2. The Not-So Beautiful Wall

Donald Trump wants to build a wall along the southern border. So do the majority of supporters who voted him into office. In fact, building the wall was perhaps the single biggest Trump campaign promise. The idea was espoused at every campaign rally, and became the biggest soundbite of his campaign. “We’re going to build a wall, and Mexico is going to pay for it” became a rallying cry for his “conservative” base. Trump shows no signs of letting this promise die.

Nor can he. With very little to show for his first 200 days in office, Trump needs border-wall funding more than ever. If this promise dies on the vine, so might his presidency. He likely views it as a battle he cannot lose.

Trump is ratcheting up the pressure to get funding authorized. And he’s using the budget negotiations to do it. Trump’s threatening to shut down the government if border wall funding doesn’t come through. As budget and debt ceiling negotiations are intertwined, failure on one front can lead to failure on the other. The administration would like to issue a “clean” debt ceiling raise, not tied to other policy measures. But publicly, at least, Trump is using the wall issue as leverage.

It remains to be seen if the wall issue leads to debt ceiling brinkmanship. Virtually all Democrats oppose border wall funding. Some moderate Republicans also oppose shutting down the government over this issue. If Trump doesn’t win this battle, he risks further alienating his base, which is starting to splinter due to lack of policy “wins.”

I’m not sure who blinks first. The risk is that nobody does and a debt ceiling debacle ensues.

3. Indebtedness Doesn’t Phase the “King of Debt”

Donald Trump loves debt. Or at least, he’s comfortable with debt. The self-professed “King of Debt” has used it liberally as a prominent real estate mogul, sometimes to a perilous extent.

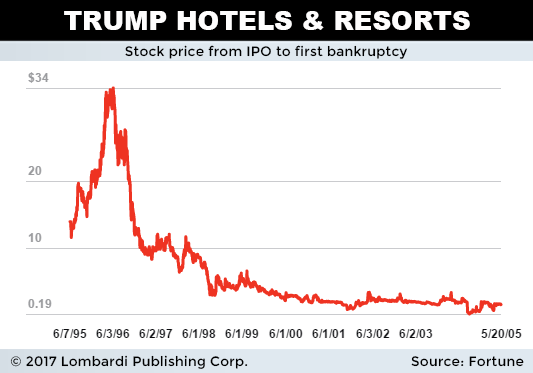

For example, Trump has filed for corporate (not personal) bankruptcy four times (1991, 1992, 2004, and 2009). Each time, it was due to excessive leverage on casino and hotel properties, most of them in Atlantic City. The $2.0 billion worth of junk bonds he used to finance the construction of the Trump Taj Mahal almost torpedoed his personal wealth in the mid-1990s, as he was unable to pay off the high interest. But eventually, he emerged from the debt abyss. (Source: “Fourth Time’s A Charm: How Donald Trump Made Bankruptcy Work For Him,” Fortune, April 29, 2011.)

Trump has also skillfully used Chapter 11 bankruptcy rules to his advantage. He has used it as a tool to renegotiate terms with creditors and to wring extra concessions from creditors who didn’t want a drawn-out and expensive bankruptcy court battle. Trump has publicly admitted as much, without a hint of hesitation, “Basically I’ve used the [bankruptcy] laws of the country to my advantage… just as many, many others on top of the business world have.” (Source: Ibid.)

What does this ultimately tell us? That we have a president who has over-leveraged himself in the past, skillfully gamed the rules to his advantage, and pulled extra concessions out of his creditors. So what makes people think it won’t happen this time around?

Sure, it’s not his personal fortune or assets on the line. But old habits die hard. It isn’t much of a leap to envision Trump hard-lining negotiations to achieve the concessions he desires. He has done it before and come out ahead (he’s a multi-billionaire). One cannot rule out a similar cavalier attitude this time around, from a man who’s “been there” before and won.

Trump claims he has no qualms about shutting down the government, and there’s no reason to disbelieve him. Who’s to say Trump doesn’t want to crack a few eggs to make an omelette?

The fact is, nobody knows what Trump is really thinking. His unpredictability, propensity to disrupt, and consistent opposition to establishment politics makes this debt ceiling negotiation unique from all others. I’m not saying it will definitely happen. But I am saying that the risks seem much more elevated than in past years. Heck, the opposition party may even desire it.

That’s a scary thought indeed.